Shipping goods into the United States isn’t always a seamless process. At some point, almost every U.S. importer will experience a clearance delay getting their goods through U.S. Customs & Border Protection (CBP). What does this mean?

In a nutshell, a clearance delay means your shipment hasn’t cleared Customs and is still in their possession. Most people assume these delays are due to U.S. Customs holding up the shipment’s arrival, however, this isn’t always the case.

Some clearance delays are not due to any action by CBP. In fact, there are many reasons a delay can occur, which we will examine further here.

Customs’ Role In The Clearance Process

CBP plays a vital role in the clearance process for international shipments. Every import shipment must be cleared by them once the goods enter the destination country, before the importer can ever receive them.

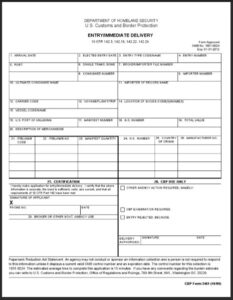

When I first began working in imports, everything was paper based. The entry packet, which would include the CF3461, commercial invoice, packing list, any other pertinent documents and the House Air Waybill (HAWB), would have to be submitted to Customs for them to release the goods.

When I was handling express consignment clearances, we could actually walk the entries over to Customs, since they were there onsite and the entries would get cleared rather quickly.

Although I worked at a “normal” freight forwarder/ Customs brokerage, our entry packet had to be taken to the Customs office at the port. Sometimes we could still get the entries back by the customs bond the end of the day, but other times it could be the next day … unless the CBP or customs officials saw something they didn’t like in the documents.

With the inception of ACE, Customs has streamlined the clearance process and made it all electronic. Gone are the days of hard copies and the customs approval process and of physically handing CBP your paperwork.

“We’re Good, Right?” A Brief Overview Of The Clearance Process

When you import a shipment into the United States, you have 15 days to get the shipment cleared through Customs. One of the most important aspects of the clearance process is good communication with your Customs Broker.

If you work with a great international shipping brokerage company, then you should always have customs brokers know if you have a shipment coming in. They should inspect the documents prior to the shipment even coming in and reach out to you if anything is missing.

This way, any issues can get resolved before the shipment even reaches the United States. If all your documents are in good order, then getting your shipment cleared should be hassle-free.

As you can imagine, that is not always the case in the real world. Although CBP has the authority to stop a shipment at any time, for any reason, here are some of the most common causes for customs delays I’ve seen during my career.

Eight Reasons For Shipment Clearance Delays

Let’s take a closer look at the most common reasons for these delays:

1. Poor Product Descriptions

A clear and accurate product description is essential to prevent clearance delays. In my experience, this is probably the number one reason why shipments get delayed. Having worked in Customs Brokerage for much of my career, I have seen it all.

Invoices that just state “parts for aircraft” or “machine parts.” That’s great. (Do you know how many parts make up an aircraft? A 747 has more than 6 million different parts.)

What are these parts? How are they classified for tariff? An invoice with any of these descriptions would be held by the broker.

Determining the Harmonized Tariff Schedule (HTS) relays solely on the description.

If a description is not complete and accurate, then this could lead to the wrong HTS being used, which could lead to incorrect duties being paid and even Customs issuing a CF28 to request more information. So, please, please … all of us import specialists are begging you … don’t write “parts” for your description.

2. Improper Documentation

Having the proper documentation is crucial for the import clearance process to go smoothly. Is your invoice complete? Do you have a Certificate of Origin if you are claiming a Free Trade Agreement (FTA)?

If you are using wood packing material, do you have the Wood Packing Material (WPM) certificate or statement on your documentation? Do you have any other documents that might be needed for Partnering Government Agencies?

Not having any of these items … or missing/incorrect information … could lead to a clearance delay, since the broker will have to wait to file the entry with Customs until they are received.

3. Incomplete Consignee or Shipper Information

Incomplete consignee or incomplete documentation and shipper information can lead to customs clearance delays too. Does your invoice show your company’s name and complete address?

If you are just the importer of record, but the shipment is being delivered to another company, is their complete name, address and Tax ID listed? Are the shipper and manufacturer different?

If so, are both companies’ names and address on the documents? All this information is important for a Customs entry. It is all required on the CF3461.

4. Incorrect Value and/or Quantity of Goods

Clearance delays can often result from incorrect documentation errors the value or quantity of goods listed on the invoice. It’s important to ensure your invoice lists all the necessary documentation and correct value for each item on the invoice.

Not just the total value, but also the unit value as well. Sometimes the unit value is needed to ensure the correct classification. You’ll also want to note on your invoice if you have any assists that need to be added to the value and what they are for.

If you are unsure of what Customs requires when it comes to transaction value on your invoice, you might want to read their Informed Compliance Publication on Customs Value.

Along with the correct value, you want to ensure the correct quantity of goods is listed. Let’s say you’re importing 10 thingamabobs on 1 pallet. Then the quantity on your invoice should be 10.

Now, let’s imagine the real world of factories, warehouses and shipping/receiving docks. How many times do you think paperwork is prepared, only to have the order changed, and someone throws another box of thingamabobs on the pallet, without bothering to update the invoice?

I can tell you from experience it happens a lot! It can even be a simple typo – someone meant to key “10” and because they were in a hurry, they forgot the “0” and just entered “1.” This will cause the entry to get a Census error. Reporting the correct quantity on the invoice is crucial.

5. Unpaid Taxes & Fees

You might experience a clearance delay if you have any unpaid taxes and fees. This could be due to CBP holding the shipment for duties or taxes that haven’t been paid or even the warehouse or container yard that your shipment came into.

If your own shipment arrives and is imported by ocean or by air that isn’t express consignment (like DHL Express, FedEx or UPS), chances are there are additional, customs declarations and fees that need to be paid to the warehouse or container yard.

Make sure you choose a reliable freight forwarder or customs broker that can assist with these fees. Most of them will pay the fee on your behalf and then bill you for it.

6. Packing and Labeling Regulations

Not following U.S. Customs regulations on packing and labelling can cause significant customs clearance delays. Make sure your goods are labeled with the country of origin and if they are too small to label, then make sure you get familiar with the methods for marking and what might not require marking.

Many years ago, I had a customer importing work gloves and their shipment was pulled for inspection by CBP. Once Customs examined the gloves, it was determined there was no country of origin label on any of them.

The customer had to create labels and a way to attach them to the gloves that was acceptable by Customs. So, I went with the customer to the Customs warehouse and spent an incredible amount of time affixing labels to EVERY pair of gloves before the shipment was released. Talk about a delay that could have been avoided!

7. Missing Client Master File Data

If you have a freight forwarder or Customs broker that handles your Customs clearances, make sure your Client Master File Data is current with them.

Most (if not all) of them have an account for your company in their database that lists various information, including clearance instructions that were provided to them by you (or someone in your company).

It’s important if any changes are needed that you communicate with your broker to ensure that the clearance of your goods runs smoothly.

8. Denied Parties

You often don’t hear much about denied parties when it comes to custom delays for import shipments. With the ever-changing landscape of the world around us and the implementation of UFLPA, this is another reason that can cause a clearance delay.

Your shipment does not necessarily have to come from China, either. These days, there seems to be an ever-growing list of “countries of concern” that can lead to custom clearance delays.

My Shipment Was Delayed. Now What?

If you don’t get it cleared, then your shipment can be sent to General Order (GO), where it will be held for up to six months. If you don’t get the shipment cleared within that time, then Customs takes possession of the goods and can auction them off or have them destroyed.

When you choose to clear the entry once it has been entered into GO, you are still responsible for the outstanding duties, plus any additional fees that can be assessed by customs authorities, such as storage.

So, the bottom line is: it’s better to get this right from the start! Work on tackling these common missteps, and you’ll be better positioned to avoid delays, fees customs inspections, seizures unnecessary delays and all of the other things that can prevent your goods from getting where they need to be – into the hands of your customers!

If you need help with Customs compliance and developing a better process to avoid these mistakes, schedule a no-charge consultation with me (or another team member) today.

Shawna Karajic is a Senior Consultant for Export Solutions -- a full-service consulting firm specializing in U.S. import and export regulations.