Another day. Another restriction against China.

Earlier this month, President Biden signed an executive order targeting U.S. investment in certain national security technologies where that investment involves “countries of concern.” Currently, these “countries of concern” are China, Hong Kong and Macau … but mostly, China. On the same day this order was signed, the Treasury Department’s Office of Foreign Assets Control (OFAC) announced a proposed new rule to implement the provisions of the executive order. Comments are due by September 28, 2023.

Let’s break this down, review the proposed rule and see what’s on the horizon.

Why is this happening? China and advanced technologies

In recent years, the United States government has voiced growing concerns about China and its targeting of U.S.-origin technologies. Various actions have been taken to thwart these efforts, primarily by OFAC and the Commerce Department’s Bureau of Industry and Security (BIS). According to these agencies, and others, China is actively employing long-term strategies to support the advancement of its own sensitive technologies.

These technologies, critical to national security, help China and other countries advance their own military, intelligence and other capabilities. Part of these efforts include acquiring (through investments, joint-ventures and other means) access to these technologies, then diverting them to help achieve military superiority.

The United States has introduced several new restrictions that target this activity. We have covered these actions extensively on our blog, most recently here and here.

New rule targets investments with China

OFAC’s proposed new rule would require U.S. persons to report certain investment activities with countries of concern. It would also prohibit other activities.

Some of the key principles being considered are:

- “Notifiable Transactions” – These are investment transactions that may contribute to national security threats, and require U.S. persons to notify OFAC for each transaction. The current proposed timeline is within 30 days of the close of a transaction (although this is subject to change when the final rule is published). OFAC is also seeking input on the content and method for these notifications.

- “Prohibited Transactions” – These would be more narrowly defined than “notifiable transactions.” These transactions would prevent U.S. persons from investing in the development of technologies that pose an “acute national security threat.”

- The new rule would apply whenever an investment is located in, or subject to, the jurisdiction of a country of concern. It would also include an investment that is owned by a person from a country of concern.

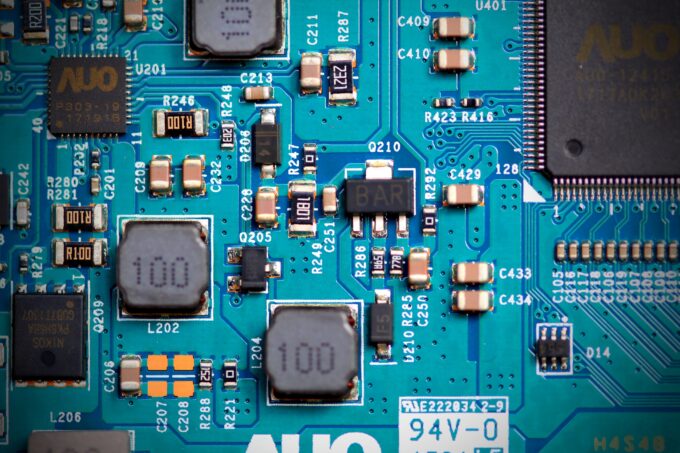

- The targeted technologies include semiconductors and microelectronics, quantum information technologies, and artificial intelligence (AI) systems.

Examples of the types of transactions that could be covered by the new rule include:

- Acquisitions of equity interests (for example, through mergers and acquisitions, private equity and venture capital);

- Debt financing where the financing is convertible to an equity interest;

- Greenfield investments (building new operations “from the ground up”) that could result in the creation of a new covered foreign person;

- Joint ventures (wherever located) with a covered foreign person or that could result in the creation of a new covered foreign person.

It’s important to remember that OFAC’s rule will apply to all “U.S. Persons.” That means, all U.S. citizens and lawful permanent residents (wherever located). It also means any legal entity organized under the laws of the United States, or any entity subject to the jurisdiction of the United States – including foreign branches of such entities. It also means any person (regardless of their nationality) located in the United States.

Next steps: Curbing U.S. investment in foreign sensitive technologies

Implementing the provisions of this Executive Order will take some time, and require input from both industry and government. The rule is currently proposed – meaning that nothing is final until OFAC issues the final rule. That said, it’s helpful to see where the agency is heading and what implications this may have on your organization.

OFAC has specifically said: “The program is not intended to impede all U.S. investments into a country of concern or impose sector-wide restrictions on United States person activity.” As such, the agency is evaluating certain “carve outs” to the rule that would more narrowly focus the scope.

Some examples of the carve outs currently being considered:

- Investments in publicly traded securities, mutual funds, index funds and exchange-traded funds;

- Certain limited partner investments where de minimis thresholds are met;

- Acquisitions where the U.S. Person acquires all interests in the entity/assets held by a covered foreign person;

- Transactions made before the effective date of the Order;

- Intracompany transfers of funds from the U.S. parent company to a subsidiary located in a country of concern.

There are also important questions that OFAC needs to consider. These are being posed to industry as part of the rulemaking process. Some of the questions on the table are:

- What specific information would a U.S. Person need to know to determine if a carve out applies?

- Are there other types of investments that should be considered for the carve outs? If so, why?

- Should some investments by U.S. Persons be allowed to continue because they help (not hinder) our national security?

- How to delineate between “notifiable” and “prohibited” transactions for each of the technology categories covered by this rule?

- How might a U.S. Person handle situations where they attempt to identify a “covered transaction” but are unable to, or they receive information they have doubts about?

- Should OFAC require prior notification for covered transactions (before they close)? Or permit U.S. Persons to notify post-transaction (after the close)?

- What unintended consequences might result from the current definitions or other proposals in the rule?

These, and other, questions will go a long way in shaping the final scope, process, timing and compliance of the new rule. For now, it’s important to realize that change is coming in the way U.S. Persons invest in certain countries of concern.

Do you think this is something to simply ignore? (They can’t really expect me to stop doing this, right?) If that’s your reasoning, then look no further than Seagate Technology’s record-breaking $300 million fine. This is what happens when companies turn a blind eye to the regulations.

Instead of ignoring this, learn about the new rules and become involved. By providing feedback and input, companies can help shape the policy and find a balance between protecting national security while still allowing U.S. investment in foreign entities.

Find out more by reading the Executive Order and OFAC’s proposed new rule.

Tom Reynolds is the President of Export Solutions, a consultancy firm which specializes in helping companies with import/export compliance.